The Traditional Collector

$24 million. Sotheby's. Farokh. FTX. The traditional art community. Gold, glistening Bored Apes. The gold level of art. Yacht Club to the moon. The floor is a joke. Ape in.

The hype behind Sotheby’s Bored Ape Yacht Club auction was real.

Sotheby’s announced their first major auction featuring the Bored Ape Yacht Club with great fanfare. On Twitter, Sotheby’s account changed their profile picture to publicize the sale: a golden Bored Ape, glistening in front of a golden Bored Ape Kennel Club dog. The post included an animation of the golden Ape, metallic hips swinging as he walked his golden dog. 101 Bored Apes were bundled on the blockchain and ready to be auctioned off.

It was bound to be a sale of historical magnitude.

“You have no idea what great exposure Sotheby’s and Christie’s will do for us,” wrote longtime Bored Ape GeeGazza in the BAYC Discord.

Many BAYC members believed that Sotheby’s big auction would ignite the market for Bored Ape assets.

"This is a club where you can hang around with NBA [stars] or CEO[s] of Silicon Valley,” wrote another user in the BAYC Discord. “I do believe 20-30 people with wealth will realize it thanks to Christie’s and Sotheby’s and will enter the club pushing prices up.”

The final bid ended up smashing records and Sotheby’s high-end estimate at $24.4 million. Most thrillingly of all, reports circulated that the winner of the auction was a “traditional” collector. Big money was coming into the Club.

And while Yacht Club prices definitely pushed up, the perception that drove the celebration of the sale was false: the true winner was not a traditional collector.

In the end, the winner was FTX.1

A “traditional” buyer?

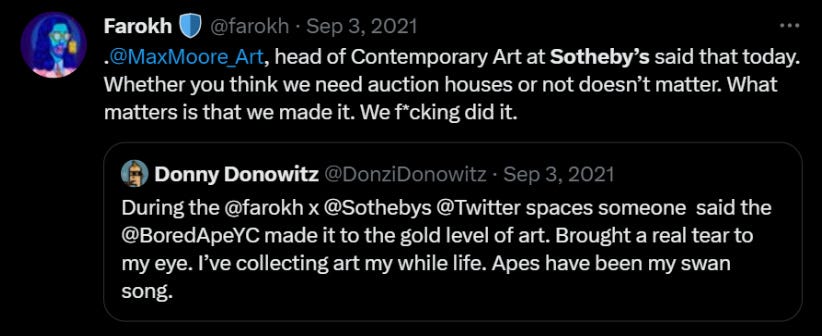

Farokh, founder and host of Rug Radio, hosted multiple official Twitter spaces to promote Sotheby’s auctions at the beginning and end of the sale. This included a space on September 3rd with the founders of Yuga Labs, the creators of Bored Ape Yacht Club. Farokh also hosted another space to celebrate the closing of the sale on the morning of September 9th.

During the first official Sotheby’s x BAYC Twitter space, Sotheby’s Head of Contemporary Art Auctions, Max Moore, reportedly said that Bored Apes made it to the “gold level of art” — an impressive endorsement from a professional art connoisseur.

Once the final bid was in, Sotheby’s Moore took it a step further. During the September 9th space, Moore affirmed that the winning bidder was a “traditional” collector.

Recordings of Farokh’s official spaces are not publicly available, but I was listening live during these spaces and personally recall hearing the “traditional” remark from a Sotheby’s representative.

Shortly after the space concluded, Farokh himself wrote: “Winner of the $24.4M lot of 101 Bored Apes is a traditional buyer and had to KYC through Sotheby’s but I guess that’s money laundering too.”

I messaged Farokh about his tweet and to get his perspective on what went down during the space with the Sotheby’s representative.

“I have hosted hundreds of spaces since then and I personally don't recall much of it,” Farokh explained. “I do this daily you know... just tough to remember all [of] the detail[s]. If I wrote that, there must've been a reason but I don't know what it was in retrospect.”

I reached Sotheby’s Vice President of Communications, Derek Parsons, for clarification.

“I can’t speak to what was said on the Twitter spaces since there isn’t a record of it,” Parsons wrote to me. “As to [Farokh’s September 2021 tweet], Farokh is not a Sotheby’s employee or in any way authorized to speak about Sotheby’s or our sales – so I would not consider his tweet in any way a representation of the sale.”

Farokh’s tweet is not the root of the issue. The real problem is that a Sotheby’s representative appeared to confirm the “traditional” collector aspect during Farokh’s space, sending signals reverberating through the community. Multiple contemporaneous accounts reported that a Sotheby’s representative confirmed a “traditional” collector.

One Twitter user, Low Mint, wrote: “Sotheby’s rep confirmed on Farokh’s space that the BAYC buyer is a traditional collector.” Low Mint’s reply tagged Max Moore.

A longstanding member of the Yacht Club, TheGovernor.eth, also tagged Max Moore in a tweet. TheGovernor added that Moore “said that the buyer of the 101 ape lot was a traditional art collector” adding that such a feat hadn’t “happened in an NFT auction before.”

Dozens of other Bored Apes repeated the claim across social media, with and without Moore’s name attached. One of BAYC’s own moderators wrote about the winner their Discord: “It was a traditional art collector with no exposure to NFTs.”

“Massively positive that the purchaser was from the traditional art community,” someone else responded in the BAYC Discord. “The ramifications of this are hard for me to even wrap my head around.”

Parsons explained that there were 13 total bidders on Sotheby’s Bored Ape lot, and that official comments from Sotheby’s employees were intended to be “reflective of the broader group of bidders – of which there were notable traditional art collectors vying for the lot.”

Max Moore did not respond to my requests for comment.

Levels of confidence: “The floor is a JOKE rn”

The narrative about the traditional buyer broke quickly into social channels: a living, breathing, private art collector was willing to spend $24.4 million to ape into the club.

Speculation over price action ran rampant in the Bored Ape community before, during, and after the auction. The “traditional buyer” element was the signifier that legitimized the sale — and for many, affirmed that Bored Apes were potentially undervalued.

The auction far surpassed Sotheby’s top-end estimate of $18 million (around 45 ETH per Ape).2 The common expectation during the auction was that the buyer would receive a discount, not pay a premium. The collection included some Apes with rare traits that would provide somewhat of a price boost, but it was surprising to many that when Bored Apes were available around 40 ETH, some eccentric art collector was willing to pay almost 69 ETH per NFT — nearly a quarter million dollars each.

Michael Bouhanna, Head of Digital Art at Sotheby’s, proudly declared the sales figure to be a “great indicator of the level of confidence in this amazing NFT project.”

“HUGE DAY,” Farokh wrote in the BAYC Discord, just after his Twitter space with Sotheby’s. “Press gonna eat the news alive … the floor is a JOKE rn.”

Skepticism about the final bid bubbled up from the sharper corners of the NFT community, where people looked at the sale with some confusion.

Meanwhile, media sites generally reported the sale with zero mention of the (missing) identity of the buyer.

The Verge reported that “the purchases show that the appetite for NFT art isn’t dying down, and they suggest that buyers think there’ll be high resale value as the market continues to grow.”

Shortly after Sotheby’s 101 Bored Apes sale, BAYC hit a new all-time high around 43 ETH per NFT. In November, following a short-lived and shallow price dip, Bored Apes began their mammoth ascent to even more eye-popping all-time highs at over 150 ETH.

ONE37pm (owned by Gary Vaynerchuk) reported that “Bored Ape Yacht Club continues to … gain more recognition in mainstream media. Their appearance at Sotheby’s continues to push the project closer to mainstream audiences and solidify it in the NFT history books.”

It’s difficult to measure exactly to what degree this sale alone impacted public perception and market dynamics. But as an observer who watched BAYC’s rise since long before launch, I felt that the Sotheby’s auction helped to paint a perception that the market for Bored Apes was more serious and eminent than the reality.

Audiences falsely were led to believe that “traditional” wealth validated the Yacht Club and saw the Bored Apes as a worthy and undervalued investment. The aggressive media push around the Sotheby’s sale coincided with other artificial events on the Bored Ape quest to be validated as the “epitome of cool.”

Who is responsible?

Farokh stressed multiple times that he doesn’t have access to Sotheby’s buyers and at the time of the auction, didn’t know the winner was FTX. He remembered that someone mentioned something about FTX, but didn’t hear any confirmation beyond hearing chatter.

Farokh (who has since invested personally into Yuga Labs) told me that the “traditional” comment was a reflection of his sincere belief at the time.

“It was awesome to host a moment like that in my personal opinion, whether some agree or not,” Farokh wrote. “I represented the buyer as a traditional buyer cause that's what I thought. No malice.”

The “traditional” buyer claim was repeated far and wide. If myself, Farokh, and the other reports collectively misunderstood Moore’s comments, there appears to be no effort from Sotheby’s end to correct the public misperception.

So did Sotheby’s play along with FTX’s ruse? Or is there a possibility that they were also blinded to what was really going down with these Bored Apes?

Did Max Moore actually have a genuine reason to believe that the buyer really was a traditional art collector?

Meanwhile, Yuga Labs very likely knew that FTX ended up receiving the Apes. Within a few months of the Sotheby’s auctions, FTX made an investment into Yuga Labs during their seed round. Yuga founder Greg Solano acknowledged that “FTX was a small investor,” but reports allegedly showing Alameda Research’s private equity portfolio revealed that FTX Ventures Ltd. invested $50 million during Yuga’s seed round.

A few weeks before Yuga announced the closing of their seed round in March 2022, Alameda received millions in a secret loan from ApeCoin DAO (created by Yuga Labs, of course).

None of Yuga’s executives, founders, or representatives clarified that it was actually a crypto firm/hedge fund that ended up with the auction prizes. The traditional collector became embedded in the narrative until watchful eyes started taking a second look in the wake of FTX’s collapse.

The fallout of Sotheby’s Bored Ape megasale raises questions about how cryptocurrency auctions at traditional art houses are engineered, promoted, and reported — and how they can be exploited.

No one besides myself has publicly confirmed that FTX / Alameda did, in fact, win the Bored Ape auction. The precise details are more complex, which I will discuss further in a piece coming soon. Sotheby’s did not provide any objection to my characterizations when I shared my original report.

If you converted the exact winning bidding into ETH prices, the winning bid was roughly equivalent to 6900 (or 6969.42 ETH). Sound “traditional”?