SCOOP: The Secret ApeCoin Loans

ApeCoin DAO gave Alameda Research and Wintermute loans worth tens of millions. The DAO also sent more ApeCoin to Wintermute afterwards. Why were these decisions made in secrecy?

Last week, I reported that ApeCoin DAO provided millions in ApeCoin ($APE) loans to Wintermute and Alameda Research.

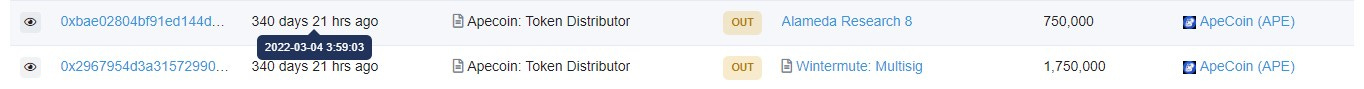

On March 3, 2022, almost two weeks prior to the launch of the ApeCoin, the ApeCoin token distributor contract made two separate APE transfers to two major cryptocurrency firms:

Wintermute received a distribution of 1,750,000 ApeCoin tokens

Alameda Research received a distribution of 750,000 ApeCoin tokens

In the first week of December 2022, the APE Foundation published a transparency report about ApeCoin, supposedly disclosing the Foundation’s financial position and flows of APE.

The APE Foundation, a foundation company incorporated in the Cayman Islands, describes itself as “the steward of ApeCoin” designed to “facilitate decentralized and community-led governance.”

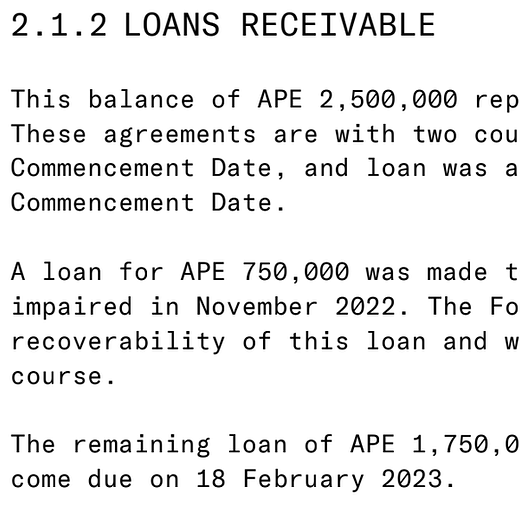

The Foundation states in the “Loans Receivable” section of the report that “a balance of APE 2,500,000 represents loans to market makers.”

Until my report, the identity of these counterparties had not been disclosed. The APE Foundation withheld the names of the counterparties from public view. There are no official acknowledgements that Wintermute and Alameda are the recipients of these loans.

On-chain evidence provides a glimpse into the truth. Yet, there are a lot of questions that require human answers about these secret loans and ApeCoin’s glaring transparency issues.

What were these loans worth?

The amount in question is equivalent to mid-eight figures in USD at a minimum — but possibly exceeds nine figures when considering the full potential context. The artificially induced volatility of ApeCoin makes it difficult to verify and portray the true scope or value of these loans.

ApeCoin launched in support of the sale of the Otherdeeds from Yuga Labs. Yuga Labs, creators of the Bored Ape Yacht Club, teased the sale of Otherdeeds for months. Holding a deed would provide access to their metaverse, co-developed with Improbable.

Despite the long hype cycle and the token launch in mid-March, Yuga released the information for the sale’s pricing less than 48 hours before the mint on April 30th.

On April 28th, Yuga Labs announced the mint cost for an Otherdeed to be a “flat price of 305 ApeCoin.” However, the price of ApeCoin itself was not flat. Anticipation mixed with uncertainty over the mint, leading to inflated APE price action.

ApeCoin spiked to an all-time high that same day, tottering around $27. In the week prior, APE was trading at less than half that price — under $12 at some points.

Yuga’s stealthy Otherside NFT sale mechanics resulted in a high-volatility black swan event for ApeCoin, creating potential windfalls for any parties with foreknowledge of these factors.

A sliver of insider knowledge would completely transform the implications of Wintermute’s and Alameda’s loans.

On the day of token launch, Alameda’s 750,000 APE loan was valued above $6 million. Wintermute’s 1,750,000 APE loan was valued above $14 million.

At ApeCoin’s all-time high, such quantities of APE were valued in excess of $20 million and $48 million, respectively. The true value of these two transfers to Wintermute and Alameda rests somewhere within a combined $20 million to $68 million.

Confirming on-chain inferences

These transfers occurred in March, but the first official mention seems to appear in the transparency report (published 9 months after the loan transactions). The APE Foundation notes that “a loan for APE 750,000 was made to a counterparty that became impaired in November 2022.”

We know that Alameda Research “became impaired” by its insolvency crisis and subsequent bankruptcy in November 2022.

We also know that Alameda and Wintermute wallets each received ApeCoin transfers on March 3rd. The two transactions add up to the balance cited in the Foundation’s report: 2,500,000 APE.

Arkham, a crypto intelligence tool, observed the connection between the transparency report and the March 3rd transactions, remarking in late December: “Onchain data indicates these were likely Wintermute and Alameda.”

I spoke to multiple sources with inside knowledge about these loans. These sources confirmed that Wintermute and Alameda are indeed the counterparties referenced anonymously in the Foundation report.

Per the transparency report, the APE Foundation “is assessing the recoverability of [Alameda’s] loan.” Wintermute’s loan “will come due on 18 February 2023.”

The ApeCoin press team did not respond to requests to confirm any details. The press team at Yuga Labs declined to provide any comment. Wintermute officials declined to comment on the loan/transfer.

What are the true purposes and terms of these loans?

The APE Foundation report states that the “balance of APE 2,500,000 represents loans to market makers.”

Market makers provide liquidity by simultaneously quoting the bid and ask. Among other avenues, they profit from the difference in the bid-ask spread. Market makers can wield the power to move markets directionally.

Wintermute is a major cryptocurrency market maker. Alameda, prior to bankruptcy, was also a prominent market maker. Authentic, healthy market making is important to providing liquidity and depth to markets.

But after examining their on-chain activity with ApeCoin, I am left with serious questions about what these firms were actually accomplishing with their funds.

Without official confirmation and elaboration, it is unclear what amount of these funds were earmarked or functionally used for market making. The transparency report merely states that the 2.5 million APE balance “represents loans to market makers.” The report provides limited insight and does not state the expressed intent of the loans.

These transfers are visible to the public. Yet, the public wouldn’t be able to fully discern the purpose of such transactions from simply reading the blockchain.

Despite the considerable size and impact of these transfers, the APE Foundation still has not disclosed the recipients, purposes, or terms of the loans. The APE Foundation’s report omits any mention of Wintermute or Alameda.

ApeCoin DAO uses the blockchain to support the illusion of transparency, but the blockchain only exposes its opaque and ambiguous nature.

$22 million: Why is there another transfer to Wintermute?

Possibly most concerning of all, there appears to be a third transfer that occurred after these “market maker” loans. On March 18, 2022, the ApeCoin Token Distributor deposited 1,749,999 APE into Wintermute’s multisignature address.

This is a separate transfer from Wintermute’s loan described above. This transaction occurred two weeks after Wintermute received the loan transfer. At that time, this APE transfer to Wintermute was worth over $22 million.

It is unclear if this transfer represents a second loan, payment in return for providing services, or some other possibility. Wintermute officials declined to comment.

Notably, the loans discussed in the sections above took place prior to the commencement of the APE Foundation, whereas this transfer took place two days after the commencement of the APE Foundation.

If this transaction is covered by the transparency report, I cannot identify the relevant section.

None of the sources affiliated with either Wintermute or ApeCoin DAO provided any explanation for this transfer. In some cases, sources seemed unaware that this transaction ever occurred.

Critical questions for ApeCoin DAO

Without any official statements from the parties involved, it is difficult to draw final conclusions. I will certainly post further updates when Wintermute and the APE Foundation elect to provide an official explanation.

The APE Foundation report failed to disclose the identities of the loan recipients or the terms of agreement, while also neglecting to describe the explicit intent or purpose behind these loans. The third transfer appears unaccounted for by any party involved.

Given the magnitude and significance of these transactions, a culture of silence and secrets seem to contradict the idea of “decentralized and community-led governance.”

The APE Foundation’s “transparency report” evades complex issues with heavy passive voice and leaves behind substantial gaps of missing information.

Two embattled crypto firms ended up with ApeCoin loans worth many, many millions. No one involved is taking accountability for these decisions or the related failures of transparency.

After learning about the secret ApeCoin loans, how could anyone believe that ApeCoin DAO is actually decentralized and autonomous?

Additional References:

“FTX Bought 101 Bored Apes at the Record-Breaking Sotheby's Auction. Securities Fraud Alert?” from Surfing the Waves

“There’s something off about ApeCoin” by Casey Newton for The Verge